If this is you every month, this is your sign to read this:

- Every month you ask yourself this question; kwani where did my money go?

- Your income is never enough to cover your monthly expenses, so you end up borrowing every time to cover expenses before you are finally paid.

- You save little to none despite making a substantial income.

Oh, end I forgot: you wait for pay day like it’s the 2nd coming of Jesus (okay, I am sorry for being harsh). If these four things, sound familiar, just know that you are not alone.

So; if this is you; here is a solution that could finally elevate your financial game…It is Budgeting-a simple but powerful tool that will help you take charge of your finances.

What Is Budgeting? Let me introduce you to the concept.

Budgeting is simply putting a plan on how to spend your money before spending it. You decide way in advance how much goes to what expense, how much goes to “living life”, how much goes to saving and how much goes to investing. Without a budget, you may find yourself spending recklessly and sometimes unknowingly foregoing the important bills and even forgetting to intentionally save.

Whether you are salaried and earn a fixed income or have irregular income because you have a business, a budget helps you:

✅ Control spending & avoid overspending

✅ Save money intentionally and achieve your goals faster

✅ Prepare for emergencies

✅ Reduce stress caused by lack of money, planning

What’s the best part? Budgeting does not require any expertise (unlike your job). Anyone can do it!

Why Budgeting Could Transform Your Finances

- You’ll stop questioning where your money disappears to. Have you ever looked at your M-Pesa statement and noticed those “just 200 bob” transactions accumulated into thousands? Budgeting enables you to track exactly where your money is spent, allowing you to reduce unnecessary expenses.

- You stay ahead of your bills instead of scrambling to catch up. With rent, utilities, Wi-Fi, and chama contributions on your list, the bills never seem to stop. A budget helps you set aside funds for these payments before you spend on other things, so you’re never blindsided.

- You can save for your major aspirations.

Whether you aim to purchase a vehicle, launch a business, or enjoy a vacation at the Coast, without a budget, these goals may only be fantasies. However, by saving a little each month, you can turn them into achievable milestones. 4. You minimize financial anxiety. Experiencing the panic of running out of funds before payday is incredibly stressful. Budgeting provides you with peace of mind because you gain control over your financial situation.

How to Begin Budgeting (Even If It’s Your First Time!)

If you’re unfamiliar with budgeting, there’s no need to be concerned, it’s simpler than you might think! Just follow these three easy steps:

- Know your earnings—Whether from your salary, side gigs, or inconsistent income, be aware of your total income.

- Keep a record of your spending to estimate monthly expenses—Document every expense, from rent to that “quick lunch” at KFC. Those small amounts can accumulate quickly!

- Distribute your funds thoughtfully—Ensure you allocate money to these categories: Essentials (rent, bills, groceries) Desires (entertainment, shopping) Debt Savings and investments

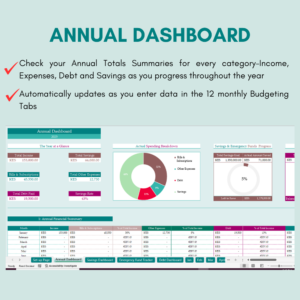

With my Annual Budgeting Template, you can:

✔ Plan your income and track your expenses effortlessly

✔ Get automated calculations-all the work has been done for you.

✔ Plan your savings and debt repayments all in one place.

Want to start budgeting like a pro? Grab your Budgeting Template today! [Shop]

Final Thoughts: Take Control of Your Money Today!

Budgeting isn’t about restricting yourself—it’s about making your money work for you! Whether you’re saving for a big goal or just want to stop living paycheck to paycheck, a budget is your best friend.

So, are you ready to start? Check out my Budgeting Template and take the first step toward financial freedom today!