Who we are and our drive

At The Wealth Basket Consulting, we are passionate about empowering individuals to take control of their financial future. Our mission is simple: to provide effective, easy-to-use tools that make managing your finances both straightforward and rewarding. Whether you’re just starting to plan your finances or looking to refine your existing strategy, our templates are designed to help you track, plan, and achieve your financial goals with ease.

Our Story

As the founder of The Wealth Basket Consulting Limited, I’ve spent the last three years training clients in financial literacy. During this time, I quickly noticed a recurring issue: while most people understood the importance of budgeting, many lacked a tool to effectively track their finances. This realization led me to understand that planning alone wasn’t enough. To truly achieve financial success, you need a reliable system to track your income, expenses, savings, and investments, and one that automatically updates as you go.

This insight led me to create a solution: a comprehensive tool that makes it easy for anyone to organize their finances, automate the tracking process, and stay on top of their financial goals. After extensive research and development, I created templates that simplify the process and save you time, so you can focus on what matters most to you—achieving your financial goals.

Why Organized Finances Matter

Imagine a life where your money works for you, and you have a clear system to help you plan and track your finances, ensuring you can achieve your financial goals.

Imagine waking up every day knowing exactly where your money is going. No more wondering how you’ll make it to the end of the month or feeling anxious about bills you can’t remember. Picture a life where you’re no longer buried in debt, struggling to keep up with expenses, or unsure if you’ll ever reach your financial dreams.

The truth is, disorganized finances create unnecessary stress and uncertainty. But when you have the right tools, you can transform your financial reality. Our templates help you:

1. Set Clear Financial Goals

Imagine being able to set specific, realistic financial goals, whether it’s saving for an emergency fund, paying off debt, or planning for a big purchase. With our templates, you can define your goals, track progress, and stay focused on your financial future.

2. Budgeting with Confidence

Now, imagine having a budget that’s simple, clear, and easy to follow. You won’t have to guess how much you can spend or worry about overspending in certain areas. With the Monthly Budgeting Tab, you can plan your income and expenses month by month. You’ll be able to track your expenses using the daily expense tracker, ensuring you know exactly where every shilling is going and can stay on top of your goals.

3. Tracking Your Expenses

By inputting your expenses into our automated system, you get a summary of your spending, and a clear picture of how your spending aligns with your goals.

This feature allows you to see where you can cut back, helping you stay on track and avoid financial surprises.

4. Tracking Your Goals Month to Month

With our templates, you can assess your spending habits each month, reassess your goals, and adjust your budget as needed. The Annual Budgeting Template for example has Savings Trackers, Emergency Fund Trackers and Debt

Repayment Trackers. This flexibility ensures that you are always aligned with your financial goals, giving you the power to adjust when life changes.

The Benefits of Using Our Templates

Our templates are crafted to make managing your finances as simple as possible, while also helping you stay organized and focused on your goals. Here’s what you can

expect:

You won’t need to worry about complicated formulas or manual calculations. Our templates come with done-for-you formulas, and the process is fully automated, so you only need to input minimal data.

- From budgeting to tracking savings, debt, and investments, our templates cover all aspects of personal finance in one space, giving you a complete view of your financial situation.

- Our clients rave about how our templates help them stay on track, visualize their progress, and make better decisions for their future.

Our Templates

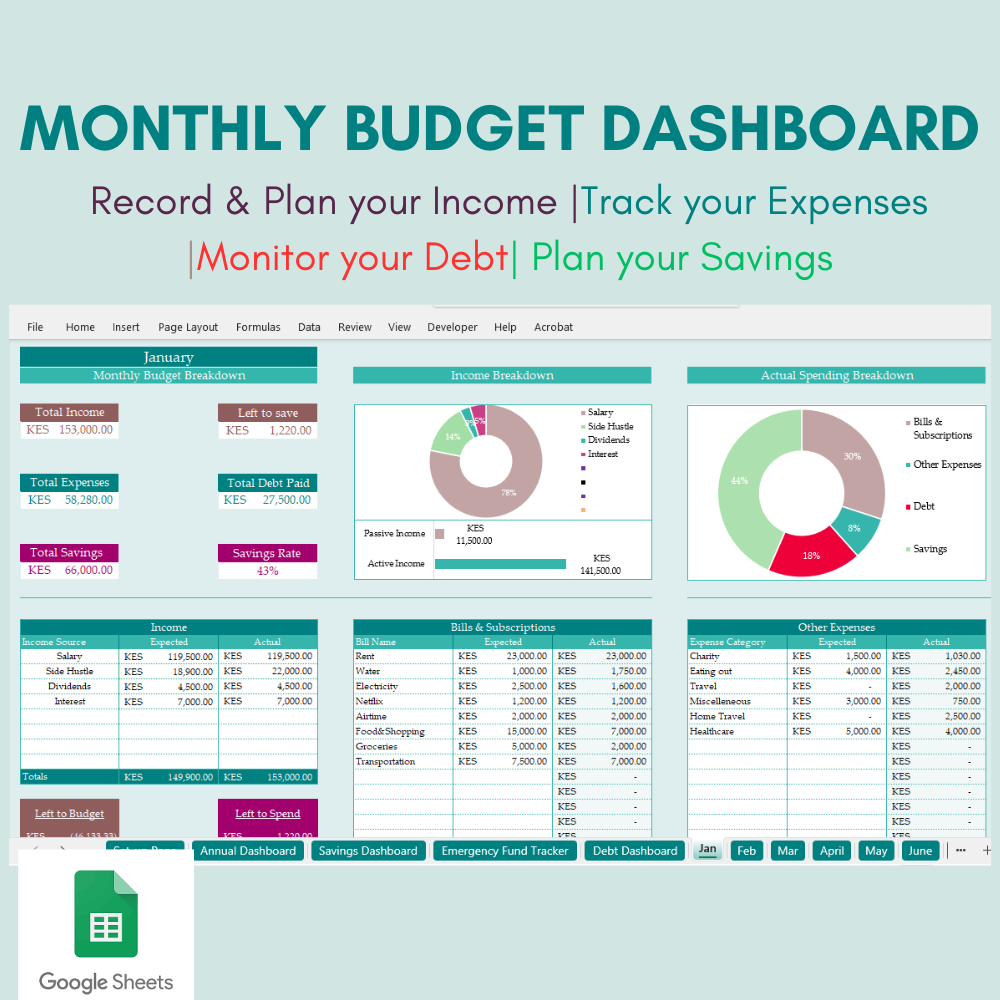

This template includes 12 monthly budgeting tabs with expense tracking on each tab, as well as a Savings and Sinking Funds Tracker, Emergency Fund Tracker, Debt Repayment Dashboard, and an Annual Dashboard to summarize everything in one place. It’s perfect for those looking to manage their finances throughout the year with a comprehensive view of their progress.

Bonus! You get a Net worth Tracker to calculate and track your Net Worth progress. A free eBook to help you understand personal finance concepts better.

Focus on month-by-month budgeting with this template, which includes 12

monthly budgeting tabs with expense tracking on each. It’s ideal for individuals

who prefer a detailed, month-to-month breakdown of their income, expenses,

and savings goals.

Bonus! A free eBook to help you understand personal finance concepts better.

Set up and track multiple savings goals, calculate your emergency fund requirements, and monitor your progress. Track up to 30 savings and sinking funds goals and keep tabs on your emergency fund savings to build a secure financial future.